Table of Contents

Living single

As long as you are single or in a partnership with no common household everything is easy money wise: you spend your money,

your partner spends his or her money. Done!

But wait! What happens, when you eat in a restaurant together? Do you split the bill or do you pay this time and your partner will pay

the next time? What happens when your partner just earns less than you do? Or the other way around?

Do you pay two times in a row and then your partner will take his/her turn? Pretty dull, huh?

Moving in together

Say you are in a long term relationship and you finally make the move and move in together.

In terms of money it gets even more complicated: you pay rent, fill your fridge together, use your car together.

How do you split it up now? “You pay the rent and I pay the gas? You pay the insurance and I the pay for the food?”

Or do you split the rent and wire it half and half to the landlord?

How do you keep track of the overall splitting thing? Do you write it down? What happens when you have to drive more or gas gets more expensive?

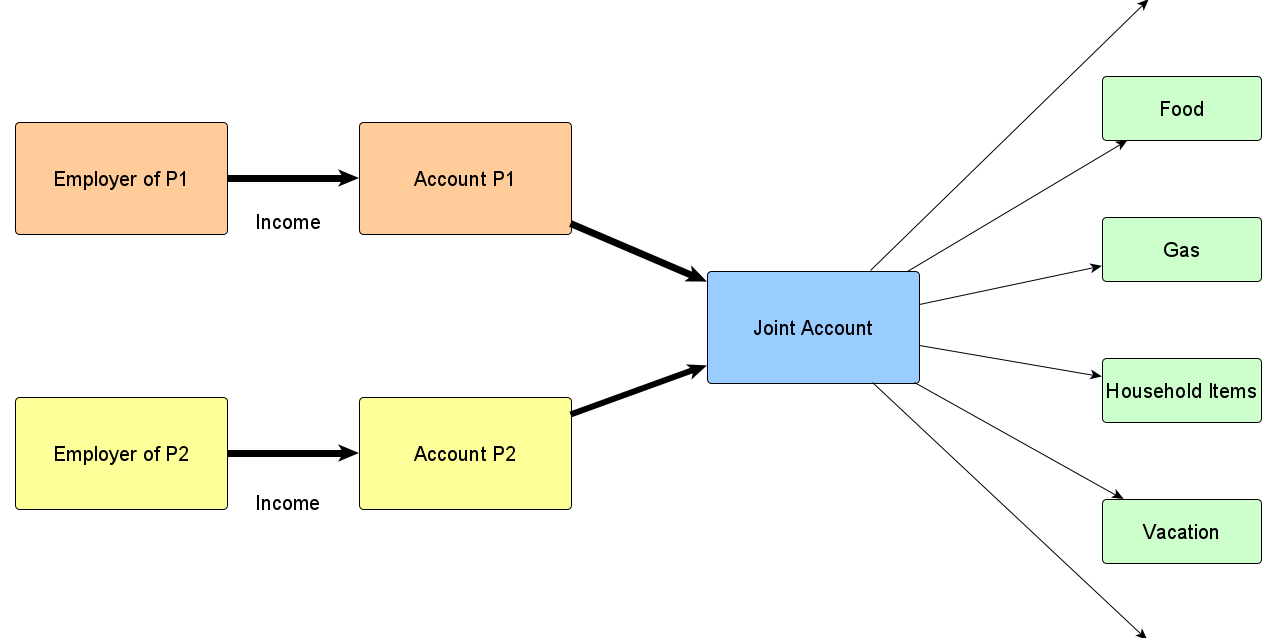

Joint Account

One remedy for this scenario could be a joint account.

To be clear: everyone keeps their own individual account but you open up a new one!

Joint account means that both partners can withdraw money without asking another.

But of course withdrawals from this account shall only be made for purchases both partners benefit from.

An example

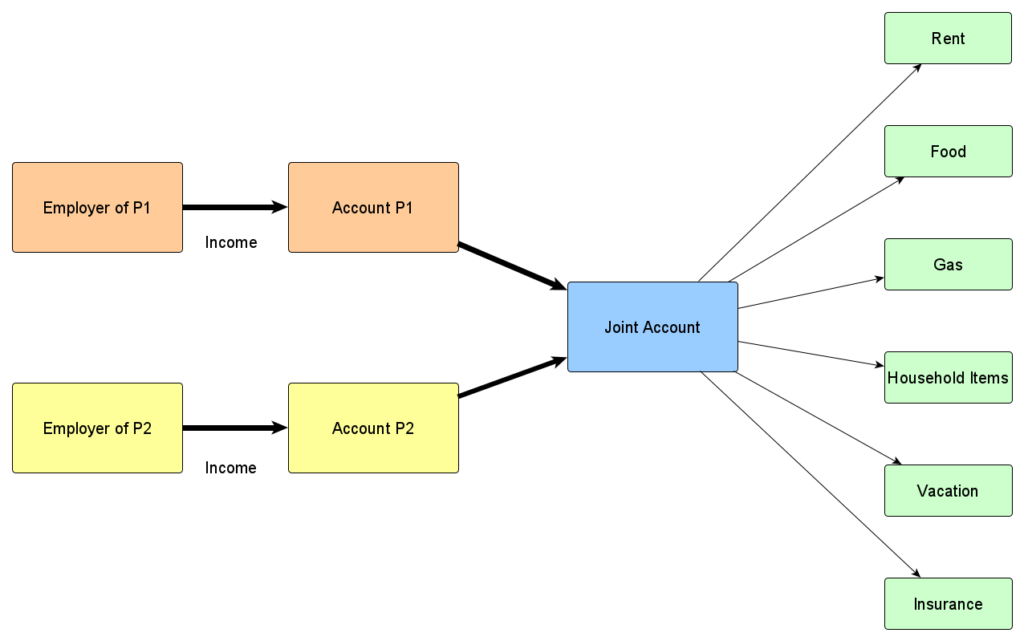

Let’s say you earn 1800€ and your partner 1200€. Your combined income is 3000€.

You know that the overall cost of living is 2000€.

Calculate the ratio of income

1800€/3000€= 60%

1200€/3000€ = 40%

Now you multiply the percentages with the overall cost of living and get what everyone should contribute to the common account.

2000€ * 60% = 1200€

2000€ * 40% = 800€

Advantage

If one or both incomes changes due to e.g. parental leave,

promotion or job change you just adjust the rates going to the joint account.

Disadvantages

This concept just works when both partners are radically transparent about their finances.

If one partner doesn’t want his partner to know what he/she earns, well…

It neither works if you mistrust your partner in financial things and assume

that he/she will spent money from the joint account on non common purchases.